The united States stands in a moment of profound transformation. As 2025 draws toward its end, political ideology , economic forces, and global power dynamics are converging in ways that could define the nation’s future for years perhaps decades to come.

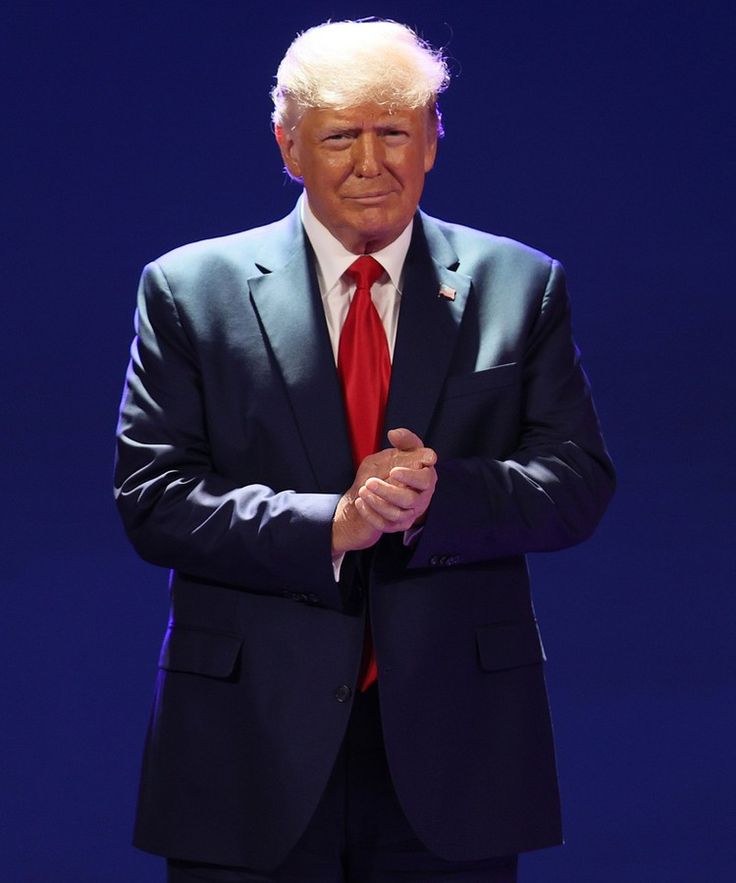

From President Donald Trump’s sweeping revision of the country’s national security strategy to the imminent interest rate decision by then Federal Reserve, the week has become a focal point for policymakers, analysts, investors, and ordinary citizens alike. Together, these developments reflect a nation wrestling with its identity, its priorities, and its place in thew global order.

A New Vision From the White House : Unraveling America’s Foreign policy Shift

The Trump administration’s new national security strategy marks one of the most decisive shifts in U.S. foreign policy in recent history. For the first time in decades, the United States is signaling a deliberate step back from its role as the world’s primary defender and mediator

Turning Away From Global Policing

For decedes, Amrican leadership has shaped international alliances, military interventions, and diplomatic efforts. The new strategy disrupts this tradition by emphasizing things such as reducing foreign military involvement, redirection of funds toward domestic priorities, greater focus on threats within the Western Hemisphere, Migration enforcement as a national security priority. This approach echos the administration’s broader message: America should look inward before looking outward.

Why the Shift Now ?

There are saveral strategic reasons are cited such as rising domestic dissatisfaction over foreign conflicts, increasing pressure on border and immigration systems , competition from China and Russia , economic vulnerability due to global instability and political promises to prioritize American citizens over global responsibilities. Supporters celebrate it as a long overdue correction to decades of overextension. Opponents warn that a retreating America creates power vacuums rivals will quickly exploit.

Impact on Global Alliances

The NATO alliance, relations with Europe, and military commitments in Asia may all feel the effects. Analysts note that reducing engagement could weaken U.S. influence, shift global power balance, encourage authoritarian regimes and reduce America’s soft power but supporters argue it frees resources for domestic rebuilding and prevents the U.S. from being “the world’s fixer”.

The Pennsylvania Rally: A Snapshot of America’s internal Divide

Trump’s rally in Pennsylvania highlighted the ongoing political polarization gripping the country. Addressing inflation, border issues, and economic frustration, he framed the moment as a battle between national strength and weakness.

The ‘Affordability Crisis’ Narrative

Trump emphasized soaring living costs, fuel prices, and immigration concerns. His message resonated with supporters who feel economic anxiety and cultural shifts have left them behind. But independent analysts noted : Some economic claims lacked accuracy, inflation trends were misrepresented, immigration statistic were selectively used. This only deepened the divide : Supporters saw a leader speaking hard truths, critics saw misinformation fueling fear.

Emotional Vs Factual Politics

The rally reinforced a trend : In modern American politics, feelings are often as influential as facts. Trump’s approach focuses on connecting emotionally, even if analysts dispute details.

The Federal Reserve’s High-Stakes Decision: A Nation Holds Its Breath

While political battles unfold, the economic front is equally intense. The Federal Reserve prepares to deliver one of its most anticipated interest rate decisions in recent years.

Inflation Still Pressures Families

Despite improvements, prices for essentials groceries, rent, transportation, and healthcare remain elevated. Millions of Americans feel squeezed, especially those living paycheck to paycheck. The Fed’s challenge: Reduce inflation without triggering a recession.

Why This Decision Matters So Much

The interest rate call will influence: mortgage costs, credit card interest rates , car loans, business investment, stock market performance and consumer confidence. A rate cut could stimulate economic relief. Holding rates steady could control inflation but maintain pressure on households. A rate increase unlikely, but possible could cool inflation but risk recession.

Markets are on edge . Financial markets have reacted with increased volatility, nervous investor sentiment, declines in business borrowing , slowdown in startup investment. Every word from the Federal Reserve is being analyzed for clues.

The Bigger Picture: What This Moment Means for America’s Future

The intersection of political and economic decisions highlights a deeper national question: What direction should America take global leadership or domestic prioritization? The answers are simple .

- domestic Struggle :Americans have to face rising costs, political division, cultural conflict, economic uncertainty, declining trust in institution.

- Global expaxtation: Allies are watching closely. Rivals are watching even more closely. The world still expects leadership from the United States, but the nation appears torn between continuation and reinventiom.

- A Defining Week : This week doesn’t just represent two events, It symbolized as a shift in power, as a test of economic stability , a measure of political influence, a question of national identity.

America stands at a crossroads and whichever direction it chooses will shape its future more profoundly than at any point in the last decade.

Proudly powered by WordPress